Putnam County Tn Property Tax Rate . the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000. To report fraud, waste & abuse: Property tax information last updated: putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. You may begin by choosing a search. what is the putnam county tax rate? The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. The median property tax (also known as real estate tax) in putnam county is $797.00 per year,.

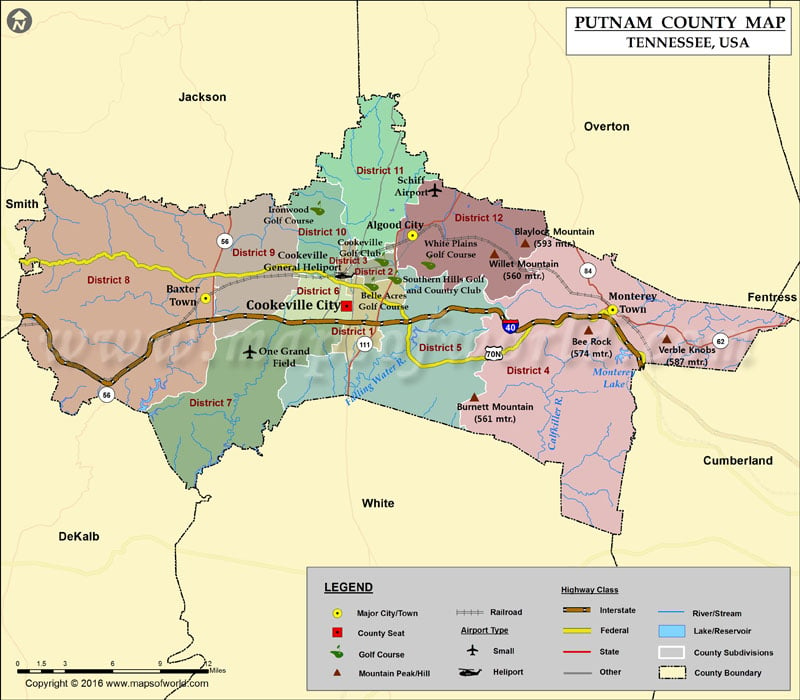

from www.mapsofworld.com

The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). To report fraud, waste & abuse: You may begin by choosing a search. Property tax information last updated: the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000. what is the putnam county tax rate? the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The median property tax (also known as real estate tax) in putnam county is $797.00 per year,.

Putnam County Map, TN Map of Putnam County Tennessee

Putnam County Tn Property Tax Rate Property tax information last updated: the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000. Property tax information last updated: You may begin by choosing a search. our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. what is the putnam county tax rate? putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. To report fraud, waste & abuse: The median property tax (also known as real estate tax) in putnam county is $797.00 per year,.

From southerngenealogybooks.com

Putnam County, Tennessee Tax 18541855 Mountain Press and Southern Putnam County Tn Property Tax Rate what is the putnam county tax rate? The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or. Putnam County Tn Property Tax Rate.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Putnam County Tn Property Tax Rate putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. You may begin by choosing a search. The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. To report fraud, waste & abuse: . Putnam County Tn Property Tax Rate.

From www.wkrn.com

Increased property values mean different things for property taxes Putnam County Tn Property Tax Rate what is the putnam county tax rate? putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). You may begin by choosing a search. The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. Property tax information last updated: To report fraud, waste & abuse:. Putnam County Tn Property Tax Rate.

From exokzjcih.blob.core.windows.net

Robertson County Tn Property Tax Search at Wesley Marshall blog Putnam County Tn Property Tax Rate The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. You may begin by choosing a search. putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000. the. Putnam County Tn Property Tax Rate.

From exobetypc.blob.core.windows.net

Pay Wilson County Tn Property Tax at Paul Mitchell blog Putnam County Tn Property Tax Rate The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. Property tax information last updated: our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. To report fraud, waste & abuse: putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee. Putnam County Tn Property Tax Rate.

From www.icsl.edu.gr

When Are Property Taxes Due In Tennessee Putnam County Tn Property Tax Rate To report fraud, waste & abuse: the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. Property tax information last updated: putnam county (0.56%) has a 3.4%. Putnam County Tn Property Tax Rate.

From www.atlasbig.com

Tennessee Putnam County Putnam County Tn Property Tax Rate The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. To report fraud, waste & abuse: the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. Property tax information last updated: our putnam county property tax calculator can estimate your property taxes. Putnam County Tn Property Tax Rate.

From dxogoaiso.blob.core.windows.net

Monroe County Tn Property Tax Rates at Gary May blog Putnam County Tn Property Tax Rate Property tax information last updated: our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. what is the putnam county tax rate? To report fraud, waste & abuse: the median property tax in putnam county,. Putnam County Tn Property Tax Rate.

From propertyappraisers.us

Putnam County Property Appraiser How to Check Your Property’s Value Putnam County Tn Property Tax Rate The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. what is the putnam county tax rate? The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the. Putnam County Tn Property Tax Rate.

From www.mapsofworld.com

Putnam County Map, TN Map of Putnam County Tennessee Putnam County Tn Property Tax Rate the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. You may begin by choosing a search. Property tax information last updated: The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. putnam county (0.56%) has a. Putnam County Tn Property Tax Rate.

From www.youtube.com

FILING PROPERTY TAX GRIEVANCE IN PUTNAM COUNTY YouTube Putnam County Tn Property Tax Rate The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. Property. Putnam County Tn Property Tax Rate.

From dxogoaiso.blob.core.windows.net

Monroe County Tn Property Tax Rates at Gary May blog Putnam County Tn Property Tax Rate You may begin by choosing a search. what is the putnam county tax rate? The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed. Putnam County Tn Property Tax Rate.

From azgroundgame.org

statepropertytaxrates The Arizona Ground Game Putnam County Tn Property Tax Rate putnam county (0.56%) has a 3.4% lower property tax rate than the average of tennessee (0.58%). Property tax information last updated: To report fraud, waste & abuse: The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. what is the putnam county tax rate? You may begin by choosing a search. The median property tax (also. Putnam County Tn Property Tax Rate.

From dxogoaiso.blob.core.windows.net

Monroe County Tn Property Tax Rates at Gary May blog Putnam County Tn Property Tax Rate To report fraud, waste & abuse: the putnam county board of commissioners set the county tax rate and each city (algood, cookeville, monterey, or baxter) will set your city taxes. the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000. our putnam county property tax calculator. Putnam County Tn Property Tax Rate.

From www.youtube.com

Putnam County Tennessee Commission Meeting 05152023 YouTube Putnam County Tn Property Tax Rate Property tax information last updated: To report fraud, waste & abuse: You may begin by choosing a search. the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000. The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. the putnam. Putnam County Tn Property Tax Rate.

From exokzjcih.blob.core.windows.net

Robertson County Tn Property Tax Search at Wesley Marshall blog Putnam County Tn Property Tax Rate our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property tax information last updated: The 2024 county tax rate is $2.66 @ $100.00 (2.66%) assessed value. the median property tax in putnam county, tennessee is $797 per year for a home worth the median value of $124,000.. Putnam County Tn Property Tax Rate.

From dxopnmdcn.blob.core.windows.net

Putnam County Tn Budget at Frederick Blumer blog Putnam County Tn Property Tax Rate what is the putnam county tax rate? You may begin by choosing a search. our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. To report fraud, waste & abuse: . Putnam County Tn Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Putnam County Tn Property Tax Rate The median property tax (also known as real estate tax) in putnam county is $797.00 per year,. what is the putnam county tax rate? our putnam county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Property tax information last updated: the putnam county board of commissioners set the. Putnam County Tn Property Tax Rate.